Transactions

.

National Expertise

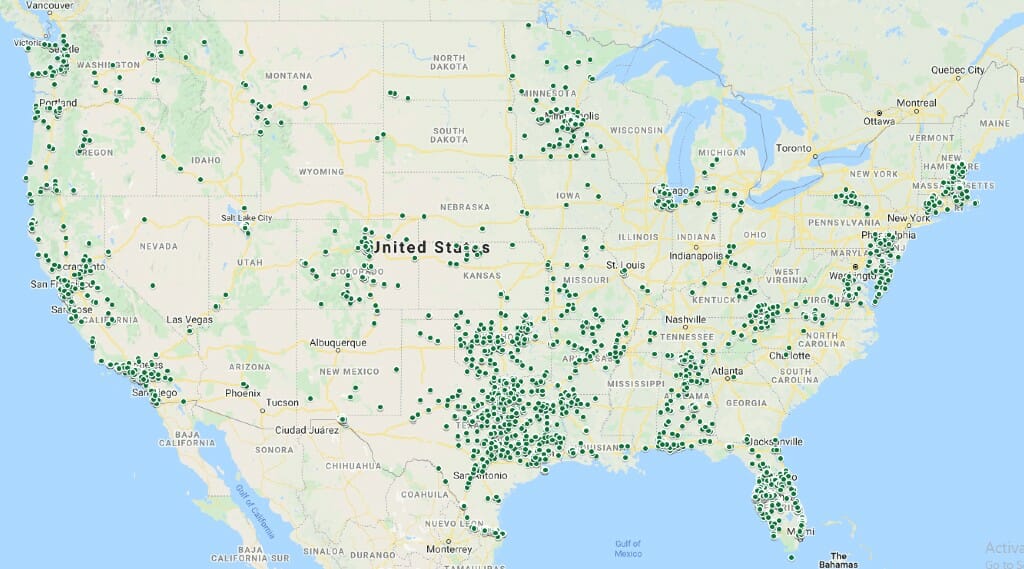

Map data represents Corner Capital engagements since 2006

Valuation, M&A, Debt Raises, Restructuring, Financial & Strategic Advisory

Clients & transactions across ~45+ states

50+ transactions over the past 5 years

Growing client advisory business for 16 years

Diverse team of former operators, company executives, and financial professionals

Select a Tombstone to view its Case Study