Diesel Production for Tomorrow’s Vehicles

It seems that every week there is new news about the rise or fall of diesel demand. As far as U.S. demand goes, diesel is not as popular as it is in other countries. A very small percentage of light duty vehicles (LDVs) use diesel compared to countries where diesel is more popular; however, diesel engines are on the rise in the U.S.

U.S. refineries are not suffering a lack of demand for diesel, however. In fact, Valero, Shell, and Marathon Petroleum are all expanding their diesel refining facilities and export terminals to maximize their ability to meet the demand on the Gulf Coast.

Why does the U.S. Consumer shy away from diesel? Most of the aversion is due to the history of diesel engines being louder and dirtier than regular gas engines. There are conflicting theories about the environmental impact of diesel vs. gasoline, mainly boiling down to the fact that they both generate pollutants, but different ones. It has not been determined whether pollutants from one or the other are actually better or worse for the environment.

The U.S. aversion to diesel is mostly a public perception issue. Indeed, Volkswagen’s recent scandal did nothing to help the argument for bringing more diesel engines to the U.S. The fact that they lied about the emissions of their engines makes it seem like diesel engines have something to hide. Can diesel engines meet emissions requirements? Are the emissions requirements founded on accurate data?

It is interesting to note that though passenger vehicles in the U.S. are primarily non-diesel, the U.S. still uses 6 times more diesel than Germany, where diesel engines are common. This is mainly because of the size difference of the countries, and the fact that the U.S. has so many large vehicles that operate on diesel. Since truckers have farther to travel, they use more fuel.

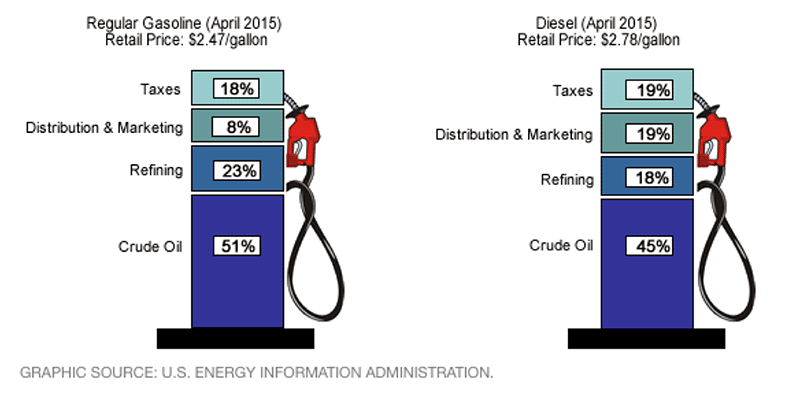

For producers, diesel is currently more profitable than gasoline. As of mid-year 2015, margins on U.S. Gulf Coast-produced diesel were running just above $16 barrel, while the margins on finished gasoline were much lower at just under $8 barrel.

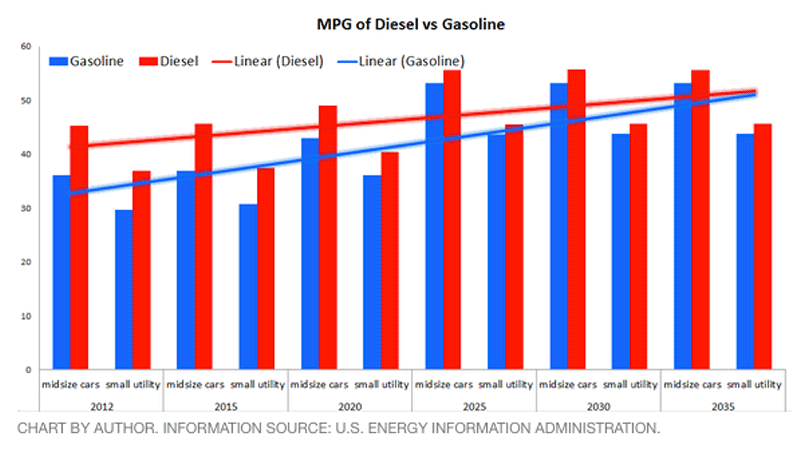

Though U.S. diesel demand is not growing at a huge rate, international demand is. Combine that with the fact that gasoline demand is going down as consumers find more fuel-efficient vehicles and alternative energy options, and it makes sense that the big producers are maximizing on diesel while they can.