Selling Your business Series

How Much is My Business Worth?

For many business owners, the value of their company goes beyond the dollar value it would reach in the marketplace. All the years of delivering goods to your customer, hiring milestones, expansion risks, and weathering a host of challenges become very difficult to quantify in your mind. There’s always an emotional aspect for any seller that feels simply “invaluable”. Energy spent on finding stellar leadership, creating branding, developing new products and solutions, implementing customer services practices, and securing top quality customer relationships: these items don’t appear on financial statements or cash flows. Are they even valuable to the market?

Every business and its overall value is subject to the supply and demand for capital, and every industry possesses unique attributes that attract interest from distributors of such capital. Capital distributors, whether venture funds or lenders, have invested fantastic sums of capital into high tech and software industries for the past 20 years. This has driven up values so incredibly that tech businesses trade on “multiples of revenue” instead of profitability metrics. Capital is attracted to industries that promise to change the world. Some early stage PropTech companies can fetch multiples around 20x revenue.

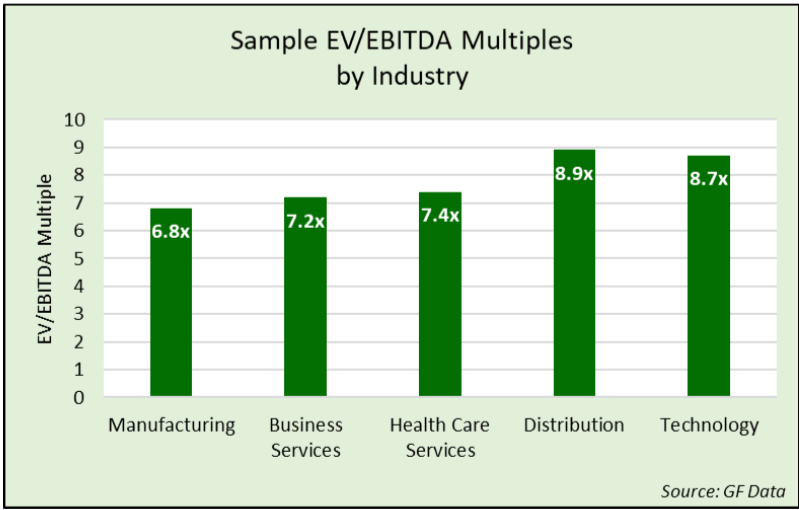

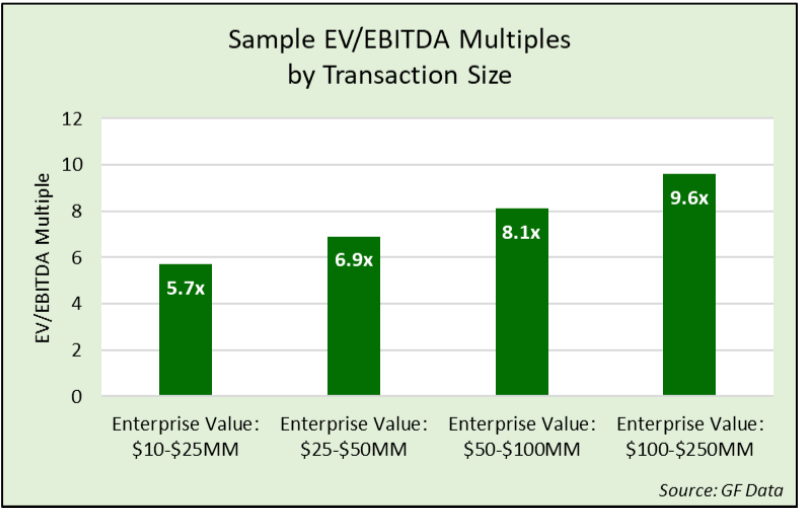

However, the majority of main street America still focuses on creating, developing, and expanding necessary and profitable businesses to serve customers. These cash flow-oriented businesses are generally valued on EBITDA multiples. And, as previously discussed, certain industries attract more capital than others. Private equity and institutional investors have driven up EBITDA valuation multiples in the HVAC and plumbing maintenance sectors to double digits. However, restaurant and more traditional industries such as manufacturing remain in the mid-single digit multiple ranges. And generally across most industries, the larger your business is, EBITDA multiples will climb with it. To answer the question of this article’s title, part of the answer is: it depends upon in which industry you operate and the size of your enterprise. A sample of private company metrics for some select industries and company sizes below should give you an idea based on data from 2020-2021.

Within those ranges provided above and within any industry segment, variability in value can come from several factors. Does your business have “lumpy” cash flows or predictable cash flows? Investors, like most buyers of a company, almost always prefer predictable or ratable cash flows. Ratable performance attracts more distributors of capital, and thus a higher value within your industry. Ratable cash flows can come from a history performance, as an example a convenience store that has demonstrated profitability for the past 3 years. Or it can come from customer contracts, that make your customers “sticky” due to your special product, service, or contract terms.

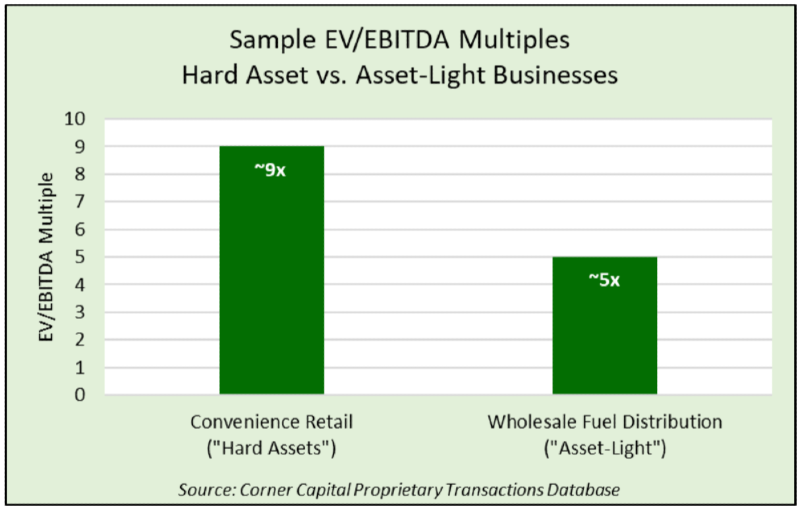

What about a business with hard assets, such as property and buildings (e.g.: convenience retail or hotel) compared to an environmental service company performing testing and consultative services. The hotel is heavy on property, building, furniture, parking lots, and staff. Those heavy assets provide depreciation and protection from taxes, and thus attract numerous distributors of capital. The environmental service company may trade at lower EBITDA multiples, UNLESS it possesses special technology or strong customer contracts that support ratable cash flows.

Let’s now address the question implied earlier of “How can I monetize all of the advantages of my emotional, strategic, and disciplined decisions and more nuanced investments in my business?” These values, to the extent they exist, are identified through the accounting term “Goodwill” but really are captured through a “premium” over industry average valuation metrics. Sticky customers? Plus value. Unique patented product or service? Plus value. Growing industry or trade market? Plus value. Leading position within your industry or market? Plus value.

While no organization in any industry is identical, buyer and advisors seek several key items that in assessing a fair value of any business. range metrics. Our firm’s goal in developing any valuation is to give a clear unbiased view of valuation, driven by industry metrics, potential premium value contributors, and the demand for capital to be distributed in your industry. A

valuation often starts with the financial statements which provide a standardized numerical way of looking at the business: top-line revenue & bottom-line cash flows on the income statements of assets, debt on the corporate balance sheet to show the loans on the business, capital expenditures to show the investments made to grow. Outside of the financials, a clear organizational chart and employee census gives a picture on how the business manages the most important asset: its team. If the business is “asset-light”, meaning there is not a lot of hard equipment or real estate involved, then reviewing all of the key customer or vendor contracts is often an important exercise to determine value. When real estate is involved, Corner Capital will review or ride every location to deeply understand each local market and the properties’ key characteristics: traffic count, competition, position of the property, sizes, offerings, among many other factors. As real estate is often a large value component that can be sold or kept, Corner Capital will determine the best possible use to maximize the value for the business owner. And lastly, what are those contributors that convey a premium to your business? That assessment, and its defensibility long-term, might be just enough to create the generational wealth you have been working for all these years. And you can then assess how the value of your emotional, strategic, and leadership decisions was achieved.

Sean Stewart, CFA

805-965-5510

Thinking about Selling Your Business?

Contact us to discuss the process.

(805) 965-5510